ENGAGEMENT

Our 2021 Q4 report highlights some of the milestones from client engagements over the past three months. Learn more about ongoing engagements as we prepare for proxy season and welcome aboard new clients for 2022 and beyond.

Table of Contents

PROXY SEASON PREPARATIONS

SHARE files 17 shareholder proposals at Canadian and U.S. firms

In the fourth quarter of 2021, SHARE filed a record 17 proxy season proposals at Canadian and U.S. firms, on behalf of its network of responsible investment leaders. Shareholder proposals are one of several used in the engagement process.

“Our goal is to get meaningful action from companies”, said Anthony Schein, Director of Shareholder Advocacy at SHARE. “These proposals – out of 75 companies we engaged in the fourth quarter – are an indication of rising investor expectations.”

According to Schein, the proposals signal three important developments among responsible investors.

“First and foremost, the proposals we have filed this year reflect the broad array of strategic priorities that the responsible investors we work with have set.” The proposals address the climate crisis, racial justice, reconciliation with Indigenous people, worker rights, health equity, supply chain due diligence, and technology sector accountability for human rights. “

“Secondly, we have put forward extremely ambitious proposals – and I am confident that we will see positive results – whether in the form of voluntary settlements or strong shareholder votes.”

The proposals address finance, insurance, pharmaceuticals, telecommunications, grocery retail, quick service restaurants, logistics, and manufacturing firms, and push for adoption of leading governance and policy standards.

“We are directly addressing the rapid acceleration to a net-zero economy. Our proposals on workforce issues directly address respect for fundamental labour rights, and the explicit connection between poor wages and lost value in the context of the ‘great resignation.”

Schein added “Finally, I am particularly proud of the leadership that the investors we work with are taking this year, including the nine investors that have filed resolutions for the first time.”

Fourteen different investors stepped up to file proposals, according to Schein, including nine who did so for the first time.

The new filers include an asset manager, a multi-billion dollar public sector pension fund, multiple foundations, a trade union and an Indigenous trust. “The investors we work with see the need for transformational change in capital markets toward a sustainable, inclusive and productive economy.”

Filers by the Numbers

- First time filers: 9

- Pension fund filers: 2

- Religious filers: 5

- Indigenous Trust Filers: 1

Proposals by Topic

- Racial Justice in Products & Services: 3

- Reducing Greenhouse Gas Emissions/Sustainable Finance: 3

- Investing in the Indigenous Economy: 4

- Health Access & Equity: 1

- Civil & Political Rights in Technology: 2

- Decent Work in Branded & Domestic Operations: 6

NET ZERO COMMITMENTS

Agreement with Scotiabank to accelerate net-zero transition

“The role of bank lending decisions is among the most important, and least well understood levers available to accelerate climate transition,” says Jennifer Story, Associate Director of Climate Advocacy.

Canadian banks have lagged their global peers in terms of their climate action, and have been widely criticized for their continued role in financing high-emitting projects. “In the past year, we have started to see Canadian banks play catch up to their European peers. I am hopeful that their late start will provide Canadian banks an opportunity to move into a leadership position.”

In November, 2021, SHARE filed a shareholder proposal at Scotiabank, on behalf of the Trottier Family Foundation. The Foundation joined SHARE’s engagement program in 2020, and filed a proposal for the first time this year.

The proposal called “to ensure that the financial products and services it provides to the energy sector are aligned with both the Paris Agreement, and the IEA’s 1.5°C climate change scenario requirement.”

We were prepared to take this proposal to a vote – and test whether investors have come to terms with the reality of the IEA’s report” said Anthony Schein, Director of Shareholder Advocacy.

CONTINUE READING

“In the end, however, the SHARE team and the Trottier Family Foundation saw positive commitments from Scotia, and seized the opportunity to work constructively to accelerate an orderly transition.” Under the terms of the agreement negotiated, the Bank has committed to developing and implementing tools implementing public-facing tools that the bank can use, and investors can see, to measure the carbon risks in its lending portfolio.

The Bank will report publicly to investors on how it is applying these tools in its engagement and client lending practices. The Bank committed to working with SHARE and the Foundation over the course of 2022 as it develops its assessment tools. “Investors have been frustrated in the past by banks’ ‘just trust me’ approach” said Story, referring to banks’ previous assurances that they were having tough conversations with their lending clients about climate risk. “But, Scotia has agreed to pull back the curtain and let investors see whether there is rigour to the approach.”

According to Schein, the agreement provides a road map for the kinds of actions other can take. “When it comes to meeting a 1.5 degree scenario, what matters isn’t just our own direct emissions – but how we leverage our positions to bring down emissions more broadly, through our lending, through our purchasing, through how our products are being used.”

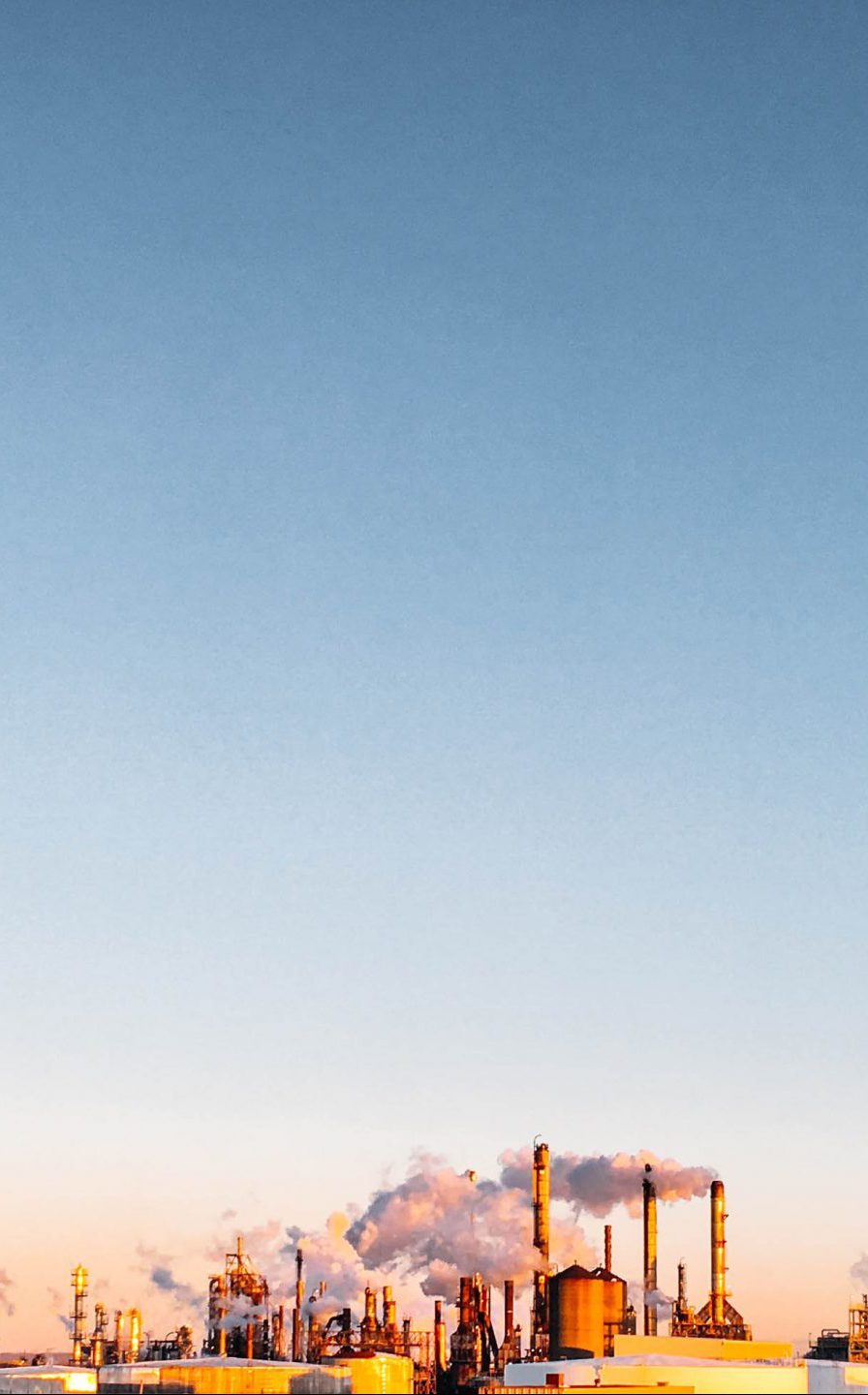

ANALYSIS – OIL WELL CLEAN-UP PROGRAM

Alberta’s oil cleanup program: A cautionary tale for investors and regulators

By Mike Toulch, SHARE and Sharmeen Contractor, Oxfam America

In April 2020, the Government of Canada launched a $1.7 billion fund to clean up abandoned and inactive wells to reduce greenhouse gas (GHG) emissions and create jobs, as part of its emergency response to the COVID-19 pandemic.

Alberta received the majority of the funding – roughly $1 billion – and immediately established the Site Rehabilitation Program (SRP) to administer the funds. Oxfam Canada and the Parkland Institute evaluated Alberta’s roll-out of the program in their report “Not Well Spent” and observed issues with effectiveness, inclusion, and transparency, which should concern investors and policymakers. Some of the report’s findings include:

- The SRP appears to be a bailout for the oil and gas industry. At the time of the report’s publication, $800 million had been disbursed and more than half ($500 million) was allocated to 15 large oil and gas companies, relieving their environmental liabilities and in direct violation of the ‘polluter pays’ principle.

- The effectiveness of the program to achieve emissions reductions was questionable and went unmeasured. Environmental risks did not appear to be a priority in site selection, even though these wells are a significant source of methane emissions.

- Jobs created are non-permanent and in predominantly non-unionized companies. Though Alberta made many publicized attempts to include Indigenous participation, efforts fell short of expectations; Indigenous company participation was significantly low compared to non-Indigenous companies.

- Lack of transparency makes it challenging to assess how funds are spent. Information related to number of sites completed, locations of sites approved for grants, GHG emissions reductions, job creation, and community engagement, especially Indigenous participation is not readily available.

STRATEGIC HUMAN RIGHTS ENGAGEMENTS

SHARE Joins Investor Alliance for Human Rights in Coordinated Engagements with Alphabet

SHARE works closely with investors across Canada, the U.S. and globally to develop strategic approaches to engagements – particularly when it comes to some of the world’s most powerful behemoths such as Alphabet, Amazon, Facebook/Meta, and Apple.

“We work to amplify our work by partnering with responsible investment leaders” said Anthony Schein, Director of Shareholder Advocacy. To a company like Alphabet, the $90 billion dollars in assets that SHARE represents is a mosquito to swat at, so it is crucial to coordinate with others.”

For its engagements with Alphabet and Meta (Facebook), SHARE coordinates with the Investor Alliance for Human Rights, an investor coalition organized through the Interfaith Centre for Corporate Responsibility (ICCR). The coalition represents investors in 19 countries, with assets totalling $8 trillion USD.

The group of investors filed eleven proposals calling for increased disclosures, risk assessments, and policy changes they say are needed to prevent significant impacts to Alphabet stakeholders including its workers, the users of its platforms, its customers, and investors. The full list of proposals, proponents, and comments for the record are available here.

While the issues raised by the proposals cover a range of environmental, social, and governance concerns (ESG), collectively they underscore how Alphabet’s unparalleled reach and influence require enhanced oversight structures to mitigate potential human rights and digital rights harms. The proposals also signal that investors are closely observing topics that, while seemingly complex, are likely to ultimately determine the architecture of the internet.

CONTINUE READING

On a parallel theme, Alphabet has previously announced plans to eliminate the use of third-party cookies through the introduction of a new technology called Federated Learning of Cohorts (FLoC). As opposed to third-party cookies, FLoC relies on algorithmically grouping users into large “cohorts” whose behavior and activities are broadly similar. Civil society actors, however, have identified potential human rights risks associated with FLoC. On behalf of the Pension Plam of the United Church of Canada, SHARE filed a proposal asking for a human rights impact assessment before FLoC is launched to ensure users’ digital rights will be adequately safeguarded.

“Alphabet has the responsibility to guarantee that the digital rights of its billions of global users are in good hands. Without proper measures to address potential digital rights harms, there will continue to be significant risks to all stakeholders involved in Alphabet’s global sphere of influence. As Alphabet prepares to revamp and widely implement its new advertising technology (FLoC), the Company must urgently provide greater transparency and due diligence on these critical issues.” said Sarah Couturier-Tanoh, Manager, Corporate Engagement & Advocacy at SHARE.

In late January, the company announced it will abandon its FloC initiative. SHARE is reviewing its strategy for engagement with the company.

Roundup of Investor Statements

SHARE is often asked to sign investor statements in support of a new set of investor principles or expectations, or asking a specific company to take action on an issue.

Here is a round up of statements signed by SHARE in the fourth quarter of 2021.

Civil and Political Rights Risks in the IT sector

SHARE signed an investor statement calling on information and communication technology (ICT) companies to respect human rights throughout their operations and value chains.

We support the Ranking Digital Rights (RDR)’s recommendations and urge companies to: (1) commit to and implement robust human rights governance; (2) maximize transparency on how policies are implemented; (3) give users meaningful control over their data and data inferred about them; (4) account for harms that stem from algorithms and targeted advertising.

Decent Work in Branded Operations

SHARE signed a letter, along with SOC Investment, NEI, Future Super, and Verve Super, calling for the resignation of the CEO, board chair and lead independent director of Activision Blizzard, as a result of ongoing governance failures and a highly publicized sexual harassment scandal. The letter is available here.

The company publishes prominent gaming brands including Call of Duty, Overwatch, and Candy Crush.

More recently, Microsoft Inc has made a $70 billion offer to purchase Activision Blizzard.

Racial Justice Commitments

SHARE signed an investor statement asking companies to increase investors’ accessibility to information related to their workplace equity policies, practices, and program outcomes. This statement will be sent to all members of the Russell 1000, along with a tailored request for additional reporting of diversity, equity, and inclusion data.

Decent Work in Supply Chains

SHARE signed a Joint Investor Letter, organized by the Coalition of Immokalee Workers, to management at Wendy’s. At Wendy’s 2021 Annual Meeting, the Franciscan Sisters of Allegany, NY, moved a shareholder proposal requesting a report on the protection of the human rights of workers in the company’s food supply chain, which received over 95% shareholder support.

With this letter, investors are asking the company to make the report available to shareholders prior to the publication of the Company’s proxy materials for the 2022 Annual Meeting, so that shareholders have adequate opportunity to evaluate Board responsiveness to the Resolution and the critical questions it raises.

Board responsibility for sustainability commitments

In response to an email sent by the ICCR, SHARE has signed on to an investor letter urging the top shareholders in Procter and Gamble (P&G) to oppose the re-election of Angela Braly to the company’s Board of Directors.

This investor letter follows a Green Century proposal filed in 2020 that received 67% support calling on P&G to address supply chain deforestation. Although P&G has released a Forestry Practices Report in response to the proposal, investors remain concerned that P&G fails to address the underlying risks and fundamental issues raised in the initial shareholder proposal. As the chair of P&G’s Governance & Public Responsibility committee, Angela Braly is largely responsible for the company’s failures in this regard.

ISS Treament of Climate Change in Voting Guidelines

SHARE signed on to a climate letter led by Majority Action asking Institutional Shareholder Services (ISS) to make changes to its benchmark proxy guidelines for the 2022 shareholder season to expand and disclose its analysis on company climate performance and whether or not they are in alignment with a 1.5°C scenario. Additionally, the letter asks that ISS incorporate company climate performance into its vote recommendations.

This letter fits within Majority Action’s broader strategy of urging investors to vote against directors at companies that fail to implement plans consistent with limiting global temperature rise to 1.5°C as discussed within their 2021 Climate in the Boardroom report.

Investor Expectations for a Just Transition

SHARE signed on to an ICCR joint statement on investor expectations for the just transition. Labour groups, environmental justice groups, and community-based organizations were consulted early in the process to inform the tone and foundations of the statement.

The statement calls on companies and investors to adopt and advocate for: (1) a foundation for decent work, job benefits, and working conditions; (2) equitable opportunities for quality jobs; (3) investing in impacted communities; (4) transparency and accountability (including with Indigenous People); (5) support for just transition policies at all levels. The statement also directly calls for a racial equity and human rights foundation to underpin just transition principles.

Are you interested in joining SHARE’s engagement program?

Shareholder engagement is a responsible investment strategy that enables investors to use their voices as shareholders to support better corporate sustainability policies and practices.

Learn More